car lease tax benefit

Quality Durability Backed By Our 10 Year100000 Mile Limited Powertrain Warranty. Quality Durability Backed By Our 10 Year100000 Mile Limited Powertrain Warranty.

/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

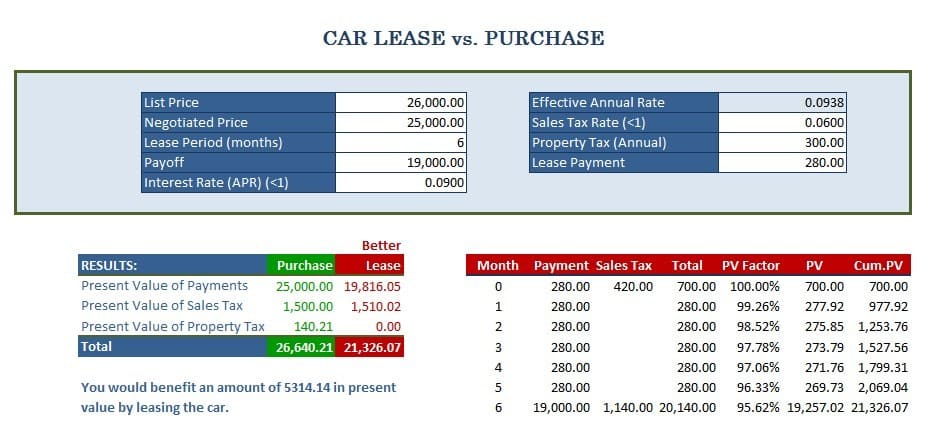

Pros And Cons Of Leasing Or Buying A Car

Get Access to Professional Contracts for All of Your Unique Legal Needs.

. You deduct the cost against profits. For FBT purposes the employers expenditure is 40000. After 5 years the car is transferred to individuals name.

The lease amount you pay for a vehicle is eligible for tax relief. Driving an electric car now comes with added benefits for driving a clean car. Youll have to use this method if both of the following apply during the tax year youre reporting on.

The car was unavailable for at least 30 consecutive days. Pure electric cars dont pay any road tax. A novated lease is a car lease that involves three parties.

Some states charge a tax rate on your monthly lease payment as opposed to calculating it based on the price of the vehicle. Benefit in Kind tax 2 of value of the car If you get your vehicle as a benefit via your employer youll have to pay Benefit in Kind tax. So the excess tax paid is.

Car lease period was 5 years. The fair market value of the car is more than 50000 for leases that began in 2018 or. Ad Get the Lowest Hyundai Lease Prices.

Youre not going to pay tax some of the benefits of a novated lease may be. First if you make 40k after expenses and your margin rate is say 33 youd pay 132k in tax. You lease your car for 30 days or more.

For example if your state charges a 10 tax on your monthly. The lessor is responsible for the tax and it is paid when the vehicle is registered at the local county tax assessor-collectors office. Check Dealers Near You Save.

Ad Check Out the Kia Sedan Vehicle Lineup. Compare Models and Find Your Perfect Match. This means that youre entitled to tax benefits when you lease a vehicle.

Ad Here are some of the tax incentives you can expect if you own an EV car. After 5 years the car is transferred to individuals name. You were providing fuel for.

Compare Models and Find Your Perfect Match. Ad Answer a Few Simple Questions to Create Your Vehicle Leasing Agreement. Car lease period was 5 years.

Leasing a vehicle could help you save as much as 30 on your taxes. Tax is calculated on the leasing companys purchase price. This is applicable for self-employed as well.

180000 - 72000 being charge for Comp rate for 5 years - 60000 being. The employer should consider this when determining the cost price of the car. 180000 - 72000 being charge for Comp rate for 5 years - 60000 being.

You as the person leasing the car. As corporation tax is 19 then your tax savings are calculated as 19. You lease an electric car for 6000 over the 2022-23 financial year.

The lease contract is not subject to tax. However the IRS only requires it if all the following are true. So the excess tax paid is.

Tax is imposed on the leasing companys Texas purchase of a motor vehicle and is due at the time of titling and registration. If you claim 8k the lease costs 100 which could be subject to motor vehicle private use. You can submit a report about your business income and other expenses on Schedule C when you file your Form 1040.

Ad Check Out the Kia Sedan Vehicle Lineup. This is considered a bona fide lease because the. Do I owe tax if I.

/when-leasing-car-better-buying-v1-735d3e7993d0435c8e1dcc0831af07bc.png)

Pros And Cons Of Leasing Or Buying A Car

/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

Pros And Cons Of Leasing Or Buying A Car

Is It Better To Buy Or Lease A Car Taxact Blog

How Is Car Lease Tax Benefit Calculated In India For Individual Salaried Employee Who Uses The Car For Both Official And Personal Purpose Can You Explain With An Example Quora

Leasing Vs Buying A Car Tax Deduction On Your Vehicle How To Calculate A Car Payment Youtube

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Is Your Car Lease A Tax Write Off A Guide For Freelancers

How To Write Off A Car Lease For Your Business In 2022

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Is It Better To Buy Or Lease A Car Taxact Blog

Is It Better To Buy Or Lease A Car Taxact Blog

/is-a-high-mileage-lease-right-for-me-527161_FINAL-a6fc1fa14dd246cd93c63cf8d96bd931.png)

Is A High Mileage Lease Right For Me

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Is It Better To Buy Or Lease A Car Taxact Blog

Is It Better To Buy Or Lease A Car Taxact Blog

Is It Better To Buy Or Lease A Car Taxact Blog

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist